Business owners and employees thrive when they serve with purpose. In Colossians 3:23, Paul urges, “Whatever you do, work at it with all your heart, as working for the Lord.” This mindset fuels excellence, not just profit. Innovation grows when work...

Welcome to chisebwe fumbeshi.com

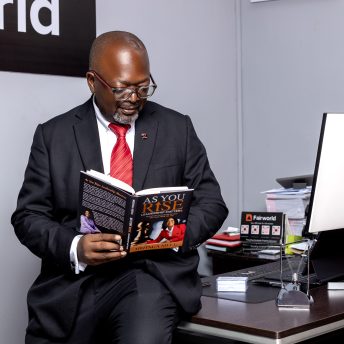

Property Valuation Surveyor, Christian Business Mentor & Entrepreneur, with vast experience in the Real Estate sector and media industry spanning more than 20 years. Registered & Chartered Valuation Surveyor, Co-founded Fairworld Properties Limited a Property Valuation and Advisory Company.